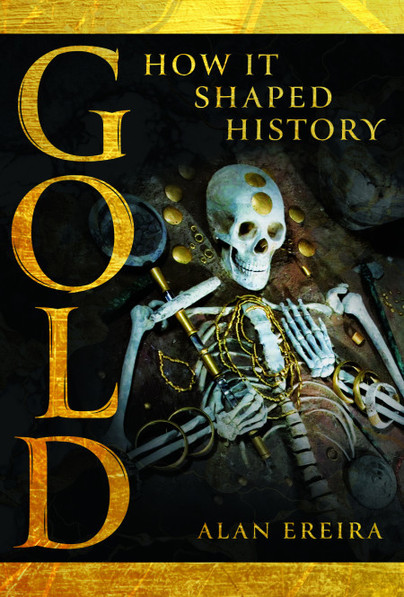

Author Guest Post: Alan Ereira

GOLD: HOW IT SHAPED HISTORY

The movement of gold and its changing value has shaped history in ways which have been fundamental and largely unremarked. Ignoring it, we have not understood the rise and fall of cultures and civilizations that used it as money. But gold is acting very forcefully now, and that is barely noticed in our news.

For over 2,500 years, until August 5, 1971, gold was the basis of money. By then the world’s money was reckoned in dollars, and that day President Nixon interrupted his nation’s favourite TV show, Bonanza, to announce that dollars would no longer be convertible to gold. The ‘gold standard’ was ended. Gold’s price was just under $45 an ounce, and it was expected that this would fall. It had little use except as jewellery. But since then its cost has risen by 6000%. This year alone it has gone up by nearly a third.

This is not because gold has become scarcer. By 1970, humans had accumulated less than 100,000 tonnes over some 7000 years. Since it does not decay or corrode, the quantity can never diminish. To many people’s surprise gold mined since Nixon’s speech has far exceeded the total extraction of gold up to that time. So today we have more than twice as much, and yet the more abundant it becomes, the more its price goes up.

This is an indication that something very strange is going on that will affect, and indeed is already affecting, the balance of power in the world.

My new book, Gold: How it Shaped History is a new history of the world based on a flood of new academic research, and a warning.

From its first discovery, gold was recognised as an extraordinary material, seemingly connected to something beyond the mortal world. More than twice as heavy as lead, shining with the brilliance of the sun, it is unchanging and imperishable. It can be hammered until it is translucent, and drawn out into a wire far finer than a hair, then rolled up unaltered. It was perceived as sacred, and for many people still is. So it is offered to deities, and used to display power and the favour of the great.

It was not a good choice as the stuff of money. Coins called staters were invented for use by long-distance traders in the 7th century BCE in the great market of Sardis, in modern Turkey. They were made of silver alloyed with gold stamped with a guarantee of value, and given in exchange for precious metals. But when Nebuchadnezzar, ruler of Babylon, needed to acquire huge quantities to pay for his city’s glorification, he looted and destroyed the largest store of precious metal he could find, the Temple of Solomon in Jerusalem. Releasing and monetizing its many tons of gold caused the price to collapse, and the stater’s value could not be sustained. The coins were melted down. That is when the ruler of Sardis, Croesus, who had a strong interest in keeping trade flowing, introduced a more stable currency. He minted separate gold and silver staters, and if the relative values of the metals changed he simply changed the weights of the coins. It worked. Herodotus said that this is where and when shopping was invented.

Gold coins would become the basis of trade and power. They would especially be the pay of soldiers, and that drove the rise and fall of empires. Rome had to conquer its neighbours to hunt for military pay. It had no gold, and what it captured was constantly draining away for luxuries bought from the east, and it was wanted for offerings for Eastern temples and northern gods. Needing more gold, Rome needed to conquer more, and then had more soldiers to pay. When the gold eventually ran out, the Empire divided and the western Empire dissolved.

This was the reason later Europeans would begin investigating and plundering other continents, firstly attacking the gold-rich lands of Islam, then reaching out to take Asia and America. They believed, of course, as they generally still do, that this mysterious metal contains intrinsic and indestructible value, so the more they could take, the richer they must be. In reality, they simply replicated the inflation that Babylon had created with Jerusalem’s gold, and Spain was locked into a long decline.

In the 18th century huge gold deposits were found in Brazil, and by clever commercial treaties Britain extracted most of it from Brazil. The rise of Britain to dominance has been mysterious but this unreported flow of gold is now known to have been three times what Spain took from America, and, unlike the Spanish, the British put it all to use, extending trade, commerce, agriculture and then industry. Gold made Britain great, in ways we never knew about.

But that greatness was the start of the long industrialised plunder of the planet, and to the crisis we now face. Gold itself is part of the destruction, Its extraction uses huge amounts of mercury and cyanide, and every ounce we get creates something like 20 tons of toxic waste. The problem is compounded by the fact that a lot of mining is actually illegal, driven by the constant price rise.

Today, money is created without limit, far exceeding what is required for trade. Elon Musk is reported to own more dollars than there are stars in the galaxy. This is an obvious route to disaster. At the same time, the US tries to control global trade by imposing dollar sanctions and tariffs.

Many countries are preparing for a return to gold, in some form, in a future post-dollar world. This is what is driving up its price. In 2019 Poland took back $100 million of its reserves from the Bank of England, in seven secret flights. Many countries in southern and eastern Europe have acted the same way. Russia is stockpiling unprecedented quantities, and China and India are hoarding all they can.

None of this is reported in national news media, but gold is still shaping history, and in ways which are unlikely to make us feel wealthier. This is a sign of deep trouble. Look out, and learn from history.

Order your copy here.